Diminishing value depreciation formula accounting

80000 365 365 200 5 32000 For subsequent years the base value. Ad Get Complete Accounting Products From QuickBooks.

Depreciation Rate Formula Examples How To Calculate

R 1 SC 1n R rate of depreciation S S is scrape value n n is the working life of an asset c c is cost of asset COMMENTS.

. Depreciation Amount for year one 1800. Using the double-declining balance method however. Net Book Value Scrap Value x Depreciation Rate Calculating Depreciation Expense using the Diminishing Balance Method.

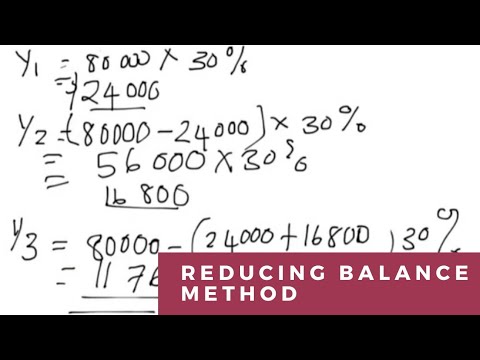

If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method. The rate of depreciation is 30 percent.

Hence using the diminishing method calculate the depreciation expenses. When using this method assets do not depreciate by an equal amount each year. For example 25000 x 25 6250 depreciation expense.

In this example the base value for the second year will be 80000 32000 48000. Cost value diminishing value rate amount of depreciation to. The depreciation for the remaining years can be calculated in the same way.

22 Diminishing balance or Written down value or Reducing balance Method. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. A method of calculating depreciation expense by allocating the cost of an asset where the annual charge is based on the declining book value of the asset after deducting the prior periods depreciation.

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Rather depreciation is recalculated each year based on the assets depreciated value or book value. Multiply the rate of depreciation by the beginning book value to determine the expense for that year.

Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its effective life at a fixed rate each year. Subtract the expense from the beginning book value to arrive at the ending book value. Diminishing balance Method Actual cost of AssetRate of depreciation100 13700020100 Depreciation Amount for 1 st year will be 2740000 Similarly we can calculate the depreciation amount for remaining years Calculation of Closing Value of 1 st year 137000-27400 10960000.

Assets cost x days held 365 x 100 assets effective life. The prime cost formula is as follows. As the book value reduces every year it is also known as the Reducing Balance Method or Written-down Value Method.

1550 - 500 x 30 percent 315. 80000 365 365 200 5 32000 For subsequent years the base value will reduce based on the difference between the current year and the next year. Depreciation Amount for year one 10000 1000 x 20.

The diminishing value method assumes that the value of a depreciating asset decreases more in the early years of its effective life. If the asset costs 80000 and has the effective life of 5 years. Year 1 2000 x 20 400 Year 2 2000 400 1600 x 20 320 Year 3 2000 400 320 1280 x 20 256 And so on and so on.

10000 2700 7300. 24 Sinking fund or Depreciation fund Method. Diminishing value method Another common method of depreciation is the diminishing value method.

This is best illustrated in an example. We still have 167772 - 1000 see first picture bottom half to depreciate. If we use the Straight Line method this results in 3 remaining depreciation values of 109715 3 36572.

If we use Straight line method this results. Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is- Depreciation Value. It is difficult to calculate optimum rate of depreciation But we can use following formula for calculating depreciation in WDV.

The closing value for year one is calculated by subtracting the depreciation from the opening value of the asset. Diminishing Balance Method Example. The rate of depreciation is 60.

Calculate Diminishing Value Depreciation First Year diminishing value claim calculation. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. If your claim seems feasible then the next step is to proceed with an appraisal.

1235 - 500 x 30 percent 220. Since the book value reduces every year hence the amount of depreciation also reduces every year. Base value days held 365 150 assets effective life Reduction for non-taxable use.

Calculate Diminishing Value Depreciation First Year diminishing value claim calculation. Get Products For Your Accounting Software Needs. For example 25000 6250 18750 ending book value at the end of the first year.

2000 - 500 x 30 percent 450. The following is the. Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value.

Depreciation Value Straight Line is not higher so we do not switch. 2 Methods of Depreciation and How to Calculate Depreciation. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value.

According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset. And the residual value is expected to be INR 24000. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

When using the diminishing value method you would record the final years depreciation as the. Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. In period 9 Depreciation Value DDB 33554.

A D V E R T I S E M E N T.

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Written Down Value Method Of Depreciation Calculation

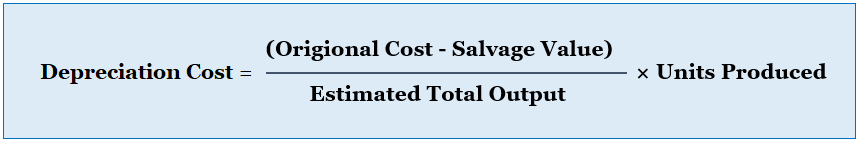

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Accumulated Depreciation Definition Formula Calculation

Depreciation Schedule Formula And Calculator Excel Template

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Straight Line Vs Reducing Balance Depreciation Youtube

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

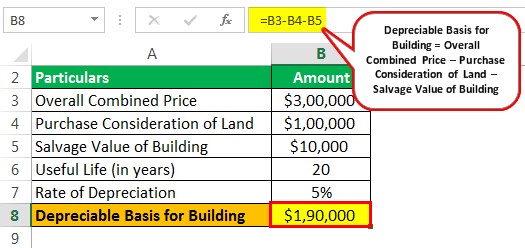

Depreciation Of Building Definition Examples How To Calculate

Depreciation Basics Accounting For Depreciation Youtube

Depreciation Calculation

Method To Get Straight Line Depreciation Formula Bench Accounting

Straight Line Depreciation Formula Guide To Calculate Depreciation